Nov

11

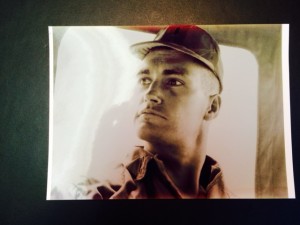

To all Vets and to their families and friends, and loved ones, we pause to say “Thank You.” The photo was taken in Vietnam, circa 1967.

Posted by William (Bill) Ford, III | Leave a Comment

Feb

4

ANNOUNCEMENT—February 5, 2015

Posted by Shirley | Leave a Comment

Bill Ford elected to the American College of Coverage and Extracontractual Counsel

Our firm is pleased to announce Bill Ford’s recent election as a fellow in the American College of Coverage and Extracontractual Counsel (ACCEC).

The ACCEC is focused on the creative, ethical and efficient adjudication of insurance coverage and extra-contractual disputes, peer-provided scholarship, professional coordination and the improvement of the relationship between and among its diverse members.

Bill stated: “I’m just plain honored to be part of ACCEC. I look forward to participating in this preeminent organization, and I’ll try hard to assist in promoting excellence and civility and professionalism in the area of insurance law and putting forth the interests of California policyholders.”

Sep

5

Good Bye Justice Croskey

Posted by William (Bill) Ford, III | Leave a Comment

We have lost a great California jurist, Justice H. Walter Croskey. This gives me pause.

My own “Bible,” the Rutter Group Insurance Litigation, sits spring-loaded and ready for action. There it is, not down the hall in a library, but right there in my office within reach.

The pages are well-worn. Marginal notes and sticky tabs abound. Look closely and you’ll see a few coffee stains. These are battle scars of research done late at night or in an airport or during a recess from trial.

OK, I admit “Croskey” is the first place—and often the only place—I go to learn or to confirm the law of insurance. Attention young lawyers: a quote from Justice Croskey, gently laced into the brief, goes a long way in most courts, trial or appellate. This is hardly a “secret” but I pass it on anyway.

Justice Croskey knew the landscape of insurance law in California exactly because he had faithfully charted its metes and bounds for many years. He wrote in a balanced way. He wrote without the baggage of any apparent ego. To me, he seemed to write as a curious student of the law would write. This is what great teachers do.

His scholarship spilled into his opinions, of course. He wrote clearly and each point flowed to the next, bonded by authority and logic. One might read any one of his opinions, put it down, and say, “Well, that’s the certainly the rule and it shouldn’t be otherwise.” That was his shared gift.

Rest in Peace Justice Croskey. Thank you.

Bill Ford

Jan

31

A WORD ABOUT OBAMA, C.S. LEWIS, COURAGE AND OTHER SOUND BITES

Posted by William (Bill) Ford, III | Leave a Comment

In his satirical apologetic, The Screwtape Letters, C.S. Lewis wrote:

“Courage is not simply one of the virtues, but the form of every virtue at the testing point, which means, at the point of highest reality.”

At the outset, let me warn you—don’t go hurling that quote into finely minced chit chat. It’s best served up on a rainy day.

So, it might rain today and here’s my point. I see in all the news that a certain lawyer appointed by President Obama is being attacked for his earlier advocacy in no less than a death penalty case. Some folks are asking, “Why did he take that case?”

I suppose the answer is, “Someone had to!”

If there is a “case” to be made for the proposition that only the least gifted and the least respected and the least ethical lawyers should handle the least popular causes, I don’t have the skill to make it.

I’m sticking with our buddy C. S. on this one. (By the way, with a name like “C.S.,” can we just agree he had to know a thing or two about courage?) Yes, it takes courage to hope. And, yes, it takes courage to just be patient even if some guy wearing pajamas is blasting tweets and snarky sharp shots from his mom’s basement about your case. I digress.

Sometimes it takes courage to just show up. Trial lawyers know it takes courage to say “Oh, hell no, this is wrong!” Maybe that’s “the highest point of reality” C.S. Lewis was referring to.

Bill Ford

1-31-14

Aug

10

CALIFORNIA SUPREME COURT ADOPTS STACKING

Posted by Claudia J. Serviss | Leave a Comment

In an important ruling issued yesterday, the California Supreme Court adopted an “all-sums-with-stacking indemnity principle.” This principle incorporates the Montrose continuous injury trigger of coverage rule and the Aerojet all sums rule, and effectively stacks the insurance coverage from different policy periods to form one giant “uber-policy” with a coverage limit equal to the sum of all purchased insurance policies on the loss.

The Court was dealing with the continuing saga of insurance coverage for the cleanup of the Stringfellow Acid Pits. (State of California v. Continental Insurance Co., et al., S170560). This site was an industrial waste disposal facility that the State designed and operated from 1956 to 1972. In 1998, a federal court found the State liable for, among other things, negligence in investigating, choosing and designing the site, overseeing its construction, failing to correct conditions at it, and delaying its remediation. The State was held liable for all past and future cleanup costs, estimated to be as high as $700 million. The State turned to six insurers which had issued one or more excess commercial general liability (CGL) insurance policies to the State between 1964 and 1976.

All insurance policies contained essentially the same promise in the Insuring Agreement: “to pay on behalf of the Insured all sums which the Insured shall became obligated to pay by reason of liability imposed by law . . . for damages . . . because of injury to or destruction of property, including loss of use thereof.”

All parties stipulated that the property damage that the Stringfellow site’s selection, design, and construction caused took place continuously throughout the defendant insurers’ multiple consecutive policy periods from 1964 to 1976. The Court observed this type of property damage, often termed a “long-tail” injury, “is characterized as a series of indivisible injuries attributable to continuing events without a single unambiguous `cause.’” (p. 7.) The damage takes place slowly over years or decades, making it “virtually impossible” for an insured to prove what specific damage occurred during each of the multiple consecutive policy periods in a progressive property damage case. (p. 8.) The Court reasoned that if such evidence were required, an insured who had procured insurance coverage for each year during which a long-tail injury occurred likely would be unable to recover.

The Court applied the reasoning of the well-known duty of defense cases Montrose and Aerojet to the current duty to indemnify question. Because it is impossible to prove precisely what property damage occurred during any specific policy period, the fact that all policies were covering the risk at some point during the property loss is enough to trigger the insurers’ indemnity obligation. The Court emphasized the “pay . . . all sums” language in the Insuring Agreement against the insurers’ argument that they should only have to pay for damages during their respective policy periods. Each insurer must pay up to the limit of each policy, “as long as some of the continuous property damage occurred while each policy was `on the loss.’” (p. 14.)

Finally, the Court addressed the issue of “stacking.” “Stacking policy limits means that when more than one policy is triggered by an occurrence, each policy can be called upon to respond to the claim up to the full limits of the policy.” (p. 15.)

The Court disapproved those court of appeal cases which had held that even without a contractual provision in the policy, policies could not be stacked. The rule was now that policies could be stacked unless the insurer and insured had contracted to the contrary. This, the Court explained, comports with the reasonable expectations of the insured – that it would receive the benefits of the policies it purchased.

Caution: The insurance policies at issue here were from the 1960’s and ‘70’s. Many recent policies contain specific anti-stacking language in the policy, which will control.

Nov

18

NEED SOME TALK POINTS FOR THANKSGIVING DINNER?

Posted by William (Bill) Ford, III | Leave a Comment

One can always start with this: A Trillion dollars is a “thousand billion.” Right? It looks like this (write it on a napkin):

$1, 000, 000, 000, 000.

Most phone number numbers have fewer digits than a trillion. For example:

1- 818- 343- 2648

OK, wait! Now that phone number thing was just an inexcusable, semi-subliminal marketing ploy. We sure won’t be doing anything that whacky again—not even to make you laugh over the holidays.

There are maybe nine galaxies for each of us—that’s eighty billion galaxies. Each galaxy harbors at least one hundred billion suns. In our galaxy, the Milky Way, there are four hundred billion suns—give or take 50 percent—or sixty-nine suns for each person alive. The Hubble space telescope shows, said an early report, that the stars are “not 12 but 13 billion years old.” Two galaxies, nine galaxies . . . one hundred billion suns, four hundred billion suns . . . 12 billion years, 13 billion years. .

These astronomers are just “nickel-and diming” us to death!

Look at our national deficit. In May 2011 it was this big:

$10, 888, 422, 676, 652 .89.

Really? Eighty-nine cents?

Have a Happy Thanksgiving. Be a hugger.

{All the funny and interesting stuff came from Annie Dillard, For the Time Being, p.72-73, the cheesy subliminal plug is ours.}

Nov

4

Daylight Saving Time 2011

Posted by William (Bill) Ford, III | Leave a Comment

Turn Clock Back 1 Hour Sunday to ‘Fall Behind’

Updated: Friday, 04 Nov 2011, 3:58 PM EDT

Published : Thursday, 03 Nov 2011, 3:06 PM EDT

MYFOXNY.COM – If you’re asking, “When do I turn my clocks back?”, it’s that time of the year when you turn clocks back one hour. Apparently not everyone is prepared to do the right thing.

Daylight Saving Time (sometimes called Daylight Savings Time) is set to end at 2 a.m. on Sunday November 6, 2011. This means the daylight will begin earlier in the morning and the sun will set earlier in the evening.

It’s also a good time to check the batteries in your smoke and carbon monoxide detectors.

“We all enjoy that extra hour of sleep as we turn back the clocks on Sunday,” said Acting State Fire Administrator Bryant D. Stevens, “but knowing that you have a working smoke alarm could help you sleep a little better and, more importantly, ensure that you wake up if a fire occurs.”

Working smoke alarms are essential in saving lives from fire. “You may have as little as three minutes to get out of your home or apartment before a fire becomes deadly,” said Stevens.

Working smoke alarms provide early warning of a fire and can provide extra time to escape safely. However, smoke alarms may not do their job if homeowners and renters don’t test them regularly to make sure that they are working.

From 2005-2009, approximately two-thirds of home fire deaths resulted from fires in properties without working smoke alarms, according to a report by the National Fire Protection Association (NFPA) titled “Smoke Alarms in U.S. Home Fires.” Many fire departments throughout New York State continue to respond to calls in homes each year where there is no working smoke alarm present.

Also check the clocks in your computers, DVD players and microwaves in case they don’t automatically adjust the time.

Why does the clock change when it does? According to a Daylight Savings Time Website, it was originally chosen because it minimized disruption by not preventing the day from switching to yesterday, which would be confusing. It is also early enough for the continental U.S. to switch by daybreak.

One of the biggest reasons for Daylight Saving Time is that it reportedly saves electricity. Studies are still being conducted to see if that long-held belief is true.

The State of California says that time zones were first used by the railroads in 1993 to standardize their schedules. In 1918, the U.S. Congress made the U.S. rail zones official under federal law.

The American law by which we turn our clock forward in the spring and back in the fall is known as the Uniform Time Act of 1966. The law does not require that anyone observe Daylight Saving Time; all the law says is that if we are going to observe Daylight Saving Time, it must be done uniformly.

WHICH WAY DO YOU TURN CLOCKS?

Apparently, some people get confused about Daylight Savings Time.

11 percent of the respondents of a 2010 survey said they were going to move their clocks forward for the end of Daylight Saving Time last November. Another five percent weren’t sure which way they were going to turn their clock.

They apparently can’t remember the “Spring Forward… Fall Behind” rule of clock setting.

The results came from a Rasmussen Reports survey of 1,000 adults.

Another finding from the survey showed that 27 percent of the respondents had arrived late or early somewhere because they didn’t change their clocks at the start or end of DST.

And less than half of the people surveyed felt like Daylight Saving Time was worth the hassle of changing clocks.

Arizona, Hawaii, American Samoa, Guam, Puerto Rico and the U.S. Virgin Islands don’t observe daylight time.

Nov

3

OUR EMAIL EXCHANGE IS CURRENTLY DOWN

Posted by William (Bill) Ford, III | Leave a Comment

Our email exchange is currently down.

We aplogize for any inconvenience this may have caused.

We expect this issue to be resolved shortly.

Thank you for your patience.

Sep

9

We pause…and remember

Posted by William (Bill) Ford, III | Leave a Comment

Four (4) . . . commercial aircraft

Ten (10) . . . years ago

Three Thousand (3,000) . . . souls

One (1) . . . Tuesday morning.

Aug

17

WHAT DO ELVIS PRESLEY AND SECTION 2860 HAVE IN COMMON?

Posted by William (Bill) Ford, III | Leave a Comment

In 1987 California enacted Civil Code §2860. This important statute deals with a very specific circumstance, namely, where [1] a policy imposes a duty to defend on an insurer and [2] a conflict of interest arises which creates a duty on the part of the insurer to provide independent counsel.

Hang in there. Here comes the sexy part.

Now, according to subsection “(f),” when the insured selects independent counsel (let’s call him “INDY”), both INDY and “the counsel provided by the insurer” (let’s call her “INSURER-SELECT”) “shall be allowed to participate in all aspects of the litigation.” Feels just like a Romeo and Juliet set up, right?

Subsection “f” goes on to say that INDY and INSURER SELECT have to sort of, well, get along. OK, actually they’re required to “cooperate fully in the exchange of information that is consistent with each counsel’s ethical and legal obligation to the insured.”

2860 (f) boils down to about five or six things—OK, exactly six things (if you’re a judge).

First, INDY has sole and exclusive control over the litigation. That’s the whole point of having “control,” right? (Look up “control” in the dictionary…it means control.)

Second, both INDY and INSURER SELECT are attorneys to the insured. As such, each is a fiduciary to the insured and each has full corresponding duties of loyalty to the insured. It couldn’t be otherwise, right? I mean a lawyer without loyalty is kind of Elvis without hips, right?

Third, INDY has only one client—the insured. INSURER SELECT has two—the insured AND the insurer (her name says it all, right?)

Fourth, both INDY and INSURER SELECT have to comply with the California Rules of Professional Conduct, particularly Rule 3-310. This means they each have to be free of conflicts of interest. “DUH!” (Sorry, I couldn’t resist.)

Fifth, the insured has to “cooperate” with the insurer. This means the insured may not unreasonably withhold consent to INSURER SELECT’s legal representation after she’s made all the requisite disclosures under 3-310. This includes explaining the insurer’s reservations of rights letter. If the insurer has reserved “all” rights—INSURER SELECT has to disclose what that means—she can always ask her other client, right?

Finally, INSURER SELECT has to exchange information “consistent with” her ethical obligation to the insured. This certainly means, at minimum, she can’t give coverage advice to the insurer and she sure as heck can’t give away information that might hurt her own client, the insured.

Have a very nice day. We’ll keep the light on.